New York Finalizes New Power Agreements for Two Large Offshore Wind Farms

Article via Maritime Executive

New York State finalized new power contracts for two offshore wind farms, Empire Wind 1 and Sunrise Wind, which had previously been placed in jeopardy when their developers said that rising costs had made the projects uneconomical for development. The signing of the new contracts puts the two mature projects back on track and helps to jumpstart New York State’s offshore wind sector.

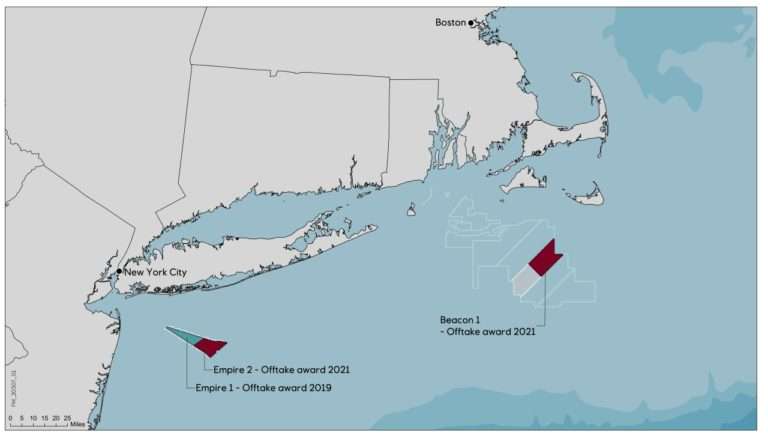

Empire Wind 1 is a planned 810-megawatt project to be developed by Equinor 15 miles south of New York, while Sunrise Wind is a planned 924-megawatt project to be 30 miles to the east in a joint venture between Ørsted and Eversource. Eversource however has agreed to sell its interests to Ørsted. Both projects were originally awarded by NYSERDA in 2019 as part of the state’s first offshore wind solicitation. The original contracts set the strike price at approximately $118 per megawatt-hour for Empire Wind 1 and $110 for Sunrise Wind.

The projects had sought to renegotiate their contracts in 2023 but the regulator New York State Energy Research and Development Authority (NYSERDA) refused. In a hastily arranged fourth solicitation, New York reopened the wind for the projects on the condition cancel their existing contracts and rebid, but they were ultimately selected. New York Governor Kathy Hochul reports the weighted average all-in development cost of the contracted offshore wind projects over the life of the contracts is now $150.15 per megawatt-hour, which she asserts is on par with the latest market prices. It is however still below the $160 that the developers had asked for last year in the negotiations for Empire Wind 1.

The governor emphasizes that the new agreement put the two projects back on track to power over one million homes. She states that the average bill impact for residential customers over the life of these projects under these awards will be approximately two percent or about $2.09 per month. They will be the largest power generation projects in New York State in over 35 years once they enter operation. Equinor plans to bring in a partner before completing a financial close by the end of the year and targeting first power by late 2026.

As part of the new contracts, the projects also agreed to an additional $32 million committed to community-focused investments and $16.5 million towards wildlife and fisheries monitoring. They must also purchase at least $188 million of U.S. iron and steel and reach a labor agreement for operations and maintenance services.

Both of the projects are mature having already completed most federal and state permitting milestones. To support the wind farm’s connection to New York’s electric grid, onshore construction relating to the Sunrise Wind project is already underway, having received approval for its proposed onshore cable route on Long Island in November 2022. Empire Wind 1 achieved a critical milestone last month when the New York State Public Service Commission approved the project’s plan to connect to New York’s electric grid. Work is underway to transform the South Brooklyn Marine Terminal into a state-of-the-art staging and assembly port and long-term operations and maintenance hub for project developer Equinor.

Restarting these two projects is critical to New York’s plans for renewable energy. In April, NYSERDA announced it was not awarding contracts from the third-round solicitation citing technical and financial considerations which they linked to GE Vernova’s decision not to manufacture the larger turbines on which the projects were based.

NYSERDA began in April seeking input for a fifth wind solicitation. It is expected to launch by summer 2024.