U.S. crude oil exports reached a record in 2023

Via AJOT

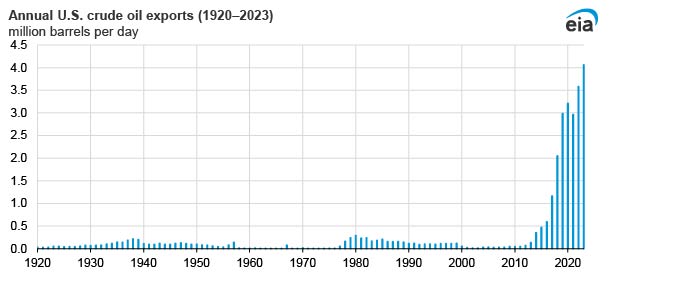

U.S. crude oil exports established a record in 2023, averaging 4.1 million barrels per day (b/d), 13% (482,000 b/d) more than the previous annual record set in 2022. Except for 2021, U.S. crude oil exports have increased every year since 2015, when the U.S. ban on most crude oil exports was lifted.

Growth in crude oil production in the United States has supported increases in U.S. crude oil exports. In 2023, crude oil production reached a record-high 12.9 million b/d in the United States, a 9% (1.0 million b/d) increase from 2022. Many U.S. refineries are optimized to run heavy, sour crude oils, but most of the crude oil produced in the United States is light, sweet crude oil, creating export incentives for market participants.

The top regional destinations for U.S. crude oil exports since 2018 have been Europe as well as Asia and Oceania. Europe became the top export destination in 2023 following the effects of Russia’s full-scale invasion of Ukraine and the inclusion of West Texas Intermediate (WTI) crude oil in Dated Brent. In 2022, U.S. crude oil exports to Europe increased significantly following Russia’s full-scale invasion of Ukraine and subsequent EU sanctions banning imports of seaborne crude oil from Russia (adopted June 3, effective December 5). These effects of the sanctions contributed to continued growth in U.S. exports to Europe in 2023. In 2023, U.S. crude oil exports to Europe averaged 1.8 million b/d, slightly more than U.S. exports to Asia and Oceania of 1.7 million b/d.

Another factor affecting the volume of U.S. crude oil exports to Europe is the inclusion of WTI crude oil in Dated Brent, a European crude oil benchmark. Prior to May 2023, the price of Dated Brent was determined based on a basket of different European crude oils. Starting in May 2023 (for physical delivery in June), WTI cargoes delivered to Rotterdam were included, likely attracting additional volumes to Europe.

The WTI crude oil to be included in determining the Dated Brent price is delivered into Rotterdam, a large crude oil storage and trading hub in the Netherlands. The Netherlands received more U.S. crude oil exports than any other country in 2023, averaging 652,000 b/d. The combination of sanctions against Russia and U.S. exports reacting to WTI’s inclusion in Brent contributed to U.S. exports to the Netherlands increasing 82% (293,000 b/d) in 2023 compared with 2022, the largest volumetric growth for any country.

China received the second-most U.S. crude oil in 2023, averaging 452,000 b/d, more than double 2022 volumes. China’s crude oil imports in 2023, the most since at least 2005, also included significantly more oil from Russia, according to data from China’s General Administration of Customs. Refinery expansions and initiatives to reopen the economy after China’s government eased COVID-19 mobility restrictions drove the rise in China’s crude oil imports. In addition, increased crude oil imports also helped increase commercial and government crude oil stockpiles in China, according to trade press.

In contrast to increasing U.S. crude oil exports to the Netherlands and China, U.S. crude oil exports to India fell 47% (146,000 b/d). India increased imports from Russia following sanctions that limited the price Russia could charge for crude oil exported using the services of sanctioning countries; importers in India have been favoring the lower-cost crude oil from Russia over crude oil from the United States. According to data from Vortexa Analytics, average annual crude oil exports from Russia to India doubled from 0.9 million b/d in 2022 to 1.8 million b/d in 2023.